We Want To Help You Reach Your Financial Goals

GET WHAT YOU NEED ...

TO FIX YOUR CREDIT

STEP BY STEP

Without Breaking The Bank!

REMOVE ERRORS

RESTORE YOUR CREDIT!

Prestige Credit Pros teaches you step by step how to reach your financial goals.

If you've had bad past money habits, they don't have to keep you from living the financial life you deserve. . . .

From: Jessica robinson

My name is Jessica Robinson, and I'm the founder of Prestige Credit Pros.

Our do it yourself course walks you through the steps you need to get right back on track towards financial prosperity.

If you're looking to build credit, this is for you...

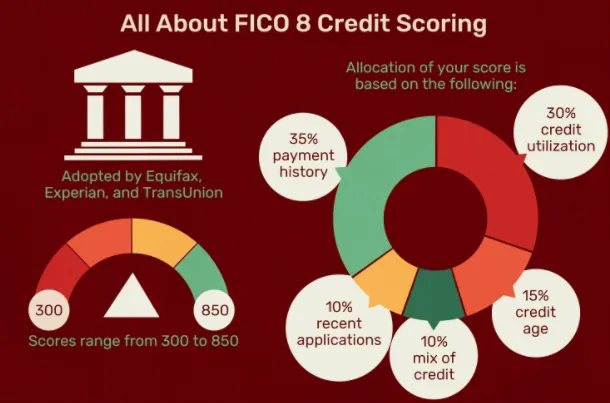

Our do it yourself course teaches you what your credit score is and how it's formulated...

Interestingly enough, the majority of people I speak to on a daily basis have ZERO idea how credit works, which in turn hurts them in the long run!

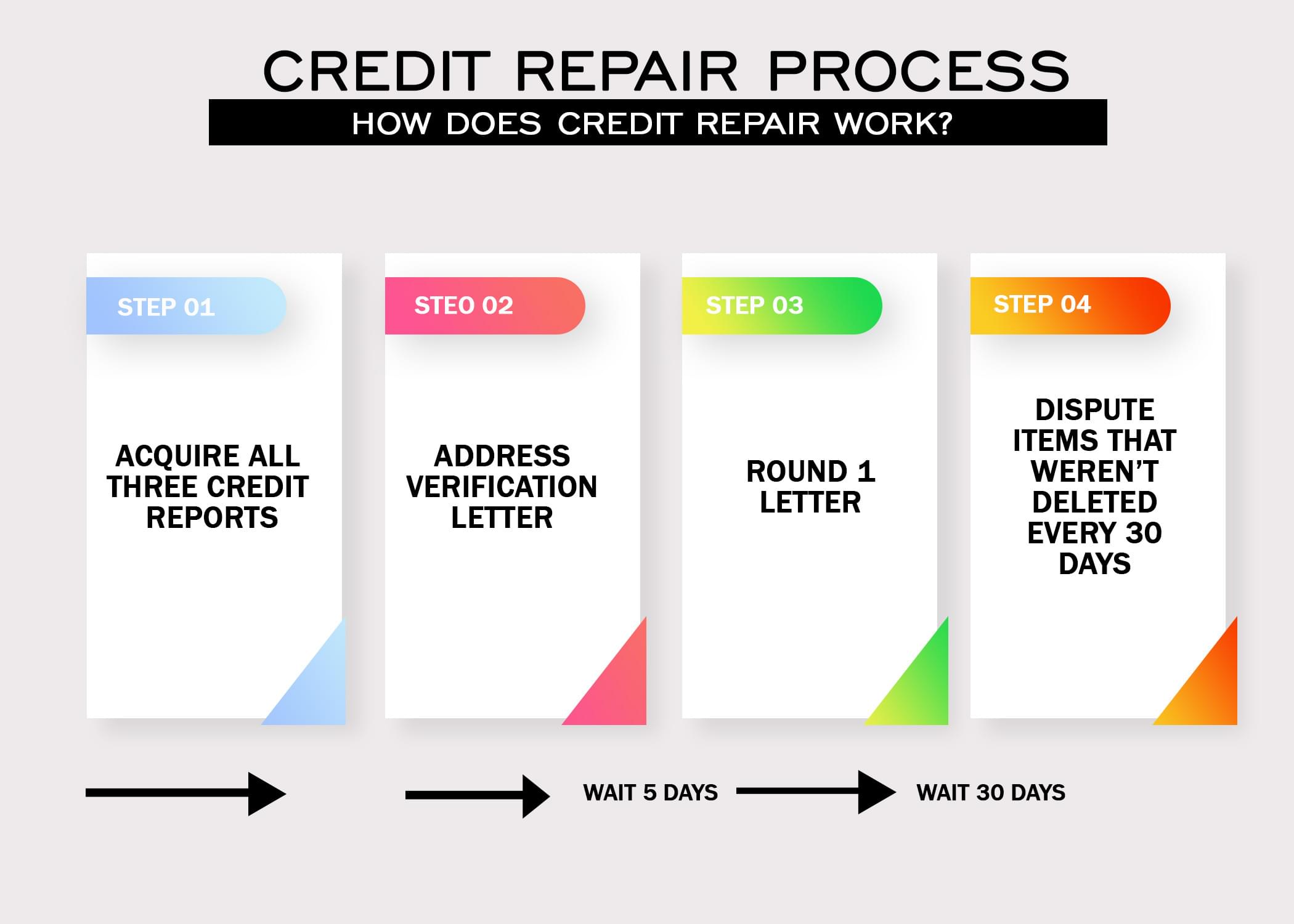

After you learn what your credit score is, we will then show you the easiest method to obtain your most up to date credit score and credit report!

We then walk you through how to remove invalid accounts that are being reported on your credit report.

- Dispute as many negative items on your credit report as you wish

- We provide you with the letters you need to correct the negative items that are being reported on your credit file

-

We provide you with the steps you need to take once you receive responses back from the credit bureaus

So... What do You Get Access to?

(And How Will This Help Me Financially!?!)

You get access to a step by step academy that will walk you through how to fix your credit.

We explain where to start, provide the letters as well as the destinations that you need to send the letters to.

Disputing negative items can be confusing, because the credit bureaus make it hard for you to clean up your credit file.

So...

With this in mind, we provide you with the zig, when they try to zag, and the zag, when they try to zig.

We know all of their tricks.

- Improve your credit, increase your financial opportunities...

-

Get that new car or that new house you deserve...

NO MORE GETTING YOUR LOAN APPLICATIONS DENIED

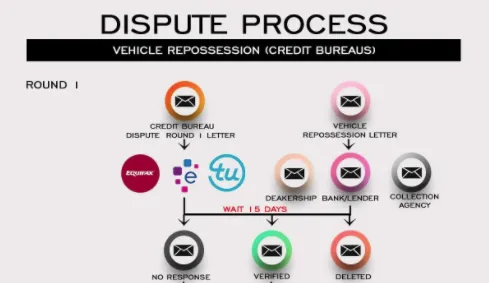

Even if you have repossessions on your credit file, we walk you through the steps to get these negative items off of your report!

Repos can be a bit tricky, but don't worry, we got you covered!

Next .. we always get questions about student loans, so don't worry .. we have you covered there too!

As long as you show up to do the work, you'll clean your credit report up in no time!

"Better Financial Health" is within your reach.

Self-Paced Do It Yourself Round 1-3 Credit Repair

($997 Value)

Self-Paced Original Creditor & Collection Agency Disputing

($997 Value)

Self-Paced How To Dispute Government & Private Student Loans

($697 Value)

Self-Paced How To Deal WIth Vehicle Repossessions

($797 Value)

Terminology List Of How To Speak To The Credit Bureaus

($297 Value)

TOTAL VALUE: $3785

This Is EVERYTHING You Need To Better Your Financial Situation

The Faster & Easier Way Buyers Get Approved

For Their Mortgages

This New Approach Increases Your Chances Of Finally Getting Approved To Move Into Your Dream Home

You can shop for a mortgage the hard way, or the easy way

If you'd like to get approved for a morgage the easy way...

Our mortgage prep program covers all of the items lenders are looking for on your credit report during the mortgage appoval process!

Plus: We'll share with you with the resources to help your chances of approval WITHOUT having to bounce from lender to lender to get the best rates

It's unfortunate that bad things happen to great people

It's often that we come across potential buyers that have past situations that prevent them from purchasing the home of their dreams

Sometimes it's a few late payments on past bills, sometimes it's one too many inquiries on their credit report

Other times, they're victims of a layoff at the wrong time, or even worse, they've experienced identity theft!

Our team is here to help you kickstart your real estate dream

Are You Looking To Purchase Your Dream Home In The Next 6-8 Months?

Before your lender even thinks about considering approving your mortgage application, they need some reassurance that you're responsible

They like to see that your debt is fairly low, because think about it, this is a large purchase!

Not to mention, you need to pay your mortgage every month, so they want to see that you have been making a decent amount of money over a period of time

Zero derogatory information!

Lenders love to see that your credit history is filled with positive payment history

Have You Been Paying Your Bills?

We all have those bills we just hate!

But you would never imagine how many applicants don't pay their bills

Sure, mistakes happen, or unfortunate circumstances like a layoff may have happened while the bills kept piling up

But these late payments need some justification

If you haven't had the best track record with paying your bills, they're more likely to deny your application without any questions asked

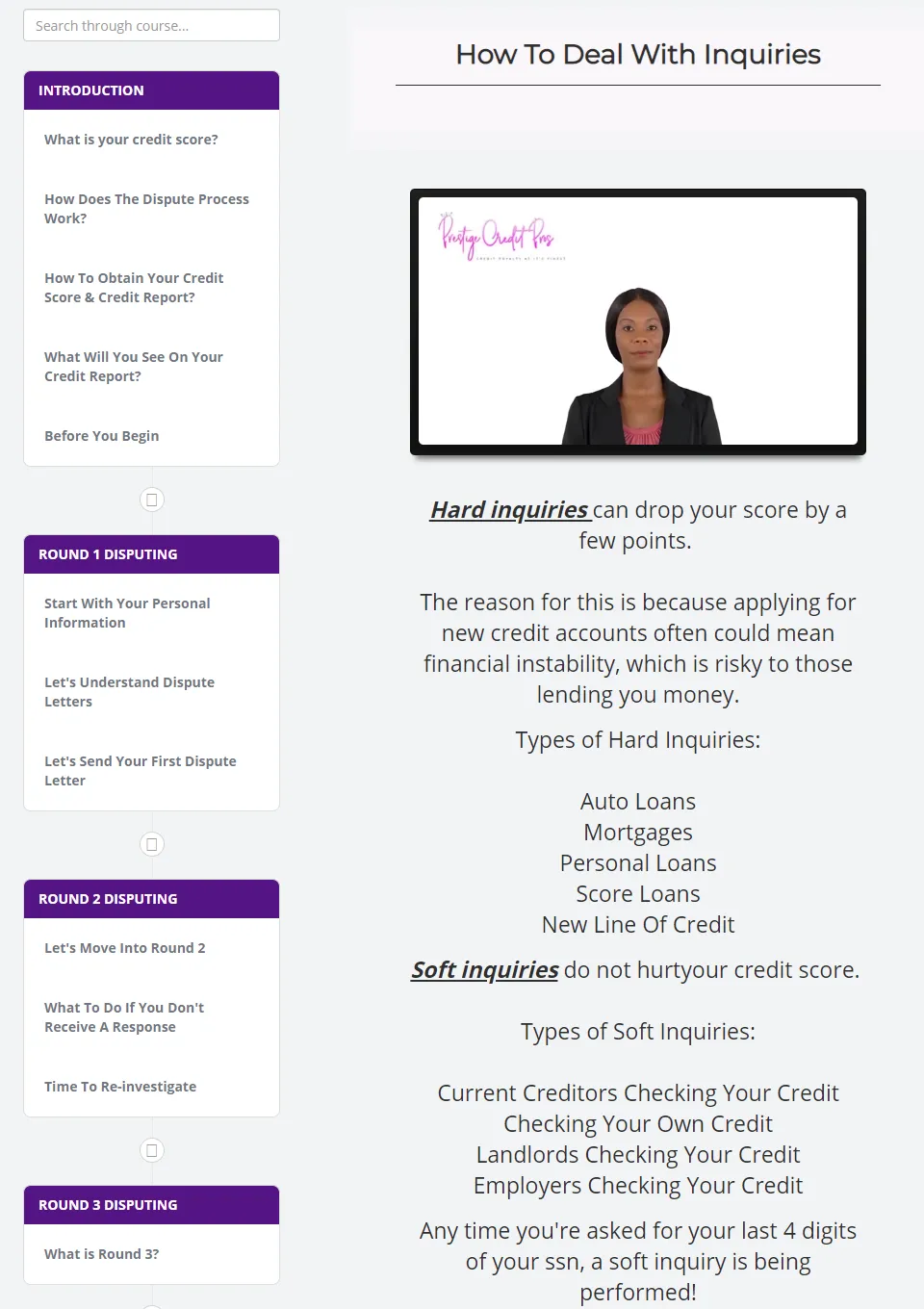

When's The Last Time You Applied For Credit?

Lenders don't like to see inquiries on your credit report

Inquiries = Risk

Risk = Denied Application

Inquiries on your credit report gives indication to the lender that you may be having financial hardship

Inquiries also affect your credit score, which means that if you're trying to find the best mortgage rates, your credit might suffer!

Each time you apply for a home loan, a lender will leave what's called an inquiry to review the past activities on your credit report

Although the inquiries are to apply for a mortgage, it is seen as taking on new debt

There's good news though, there are ways to get these inquiries off of your credit report

The Fastest Way To Get Yourself Ready For Your Approval

Our mortgage prep program is for you if you want to buy a home in the next 6-8 months and want to put yourself in the best position to get approved

You don't need to hire an expensive professional

You can certainly do this on your own!

Step 1:

Identifying your why

Why do you want to purchase this home for your family?

Are you willing to address any obstacles that may stand in your way?

Step 2:

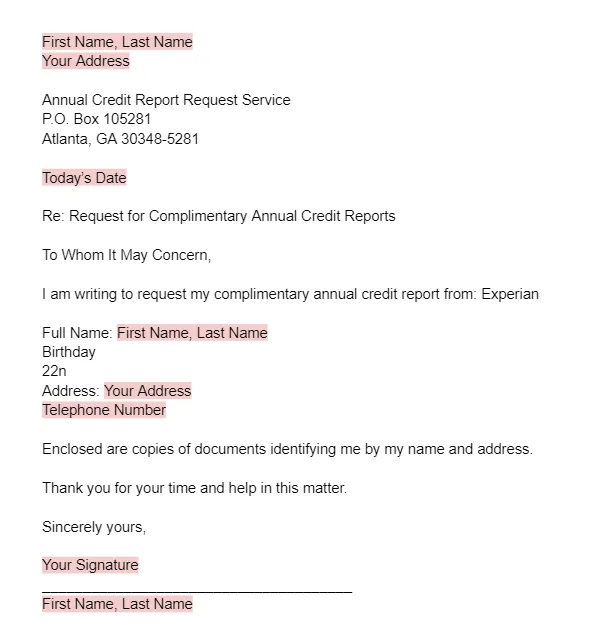

Obtain copies of your credit report

When you get your credit report, you want to analyze it

Don't worry, we'll guide you through this analysis

This step is important!

Not many people know this, but...

It's important to get all 3 copies because different lenders use different credit reporting bureaus

Here's a sample of a letter you can use to get your credit report from Experian

Just click the button, and let us know where you want us to email it

Step 3:

Remember, lenders want to see zero derogatory information!

Put together a plan of action to remove any items on your credit report that may affect your chances of approval

We provide you with step by step instructions how to do this